For startups, it is easy to get by without the services of an accountant in the beginning as there is barely any need of it. If you own a business and have access to an accounting software with the know-how of accounting for small business owners, you will do just fine. But as you continue to expand, there will be tell-tale signs that it is time to hand over the task to a professional accountant.

1. Your business has experienced a major growth spurt.

With great power, comes great responsibility. Every business owner dreams of such progress and if you are experiencing such a shift in paradigm, you will need to expand. More staff, inventory, work processes, and internal system only leads to more paperwork and calculations. It is wise to have a person dedicated to this task and responsible for keeping all the finances in order.

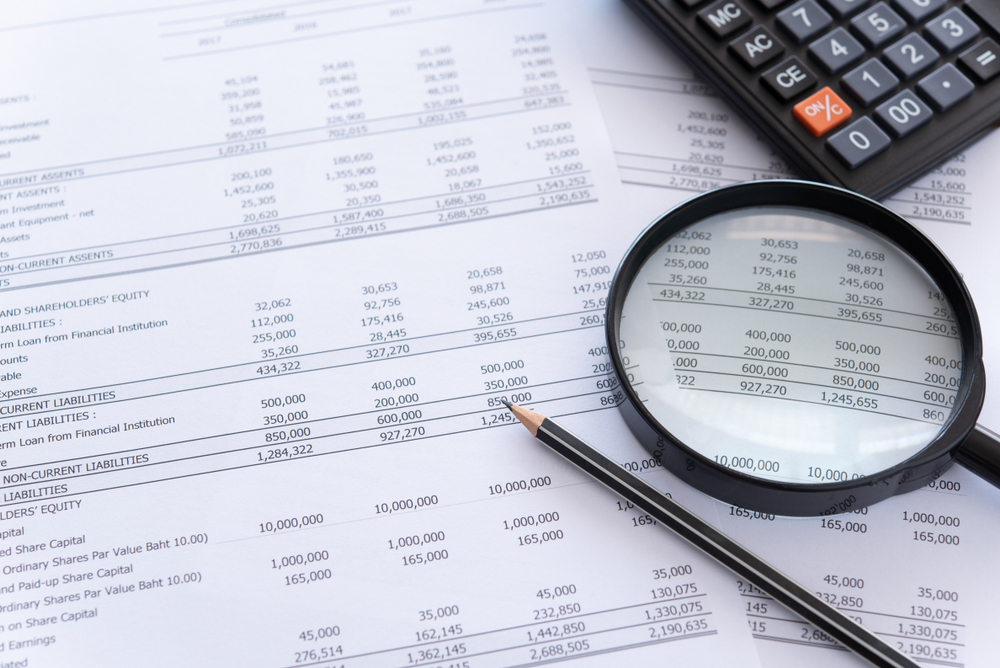

2. You find yourself in need of professional financial reporting.

If your business is in search of investors or loans, it is better to have your company’s financial state and history in order. It is one of the most integral parts of a loan application or a proposal to investors. You will need a professional who knows the trade inside out. An accountant understands the relevant information that needs to be included with financial reports to score investors and loans. An accounting specialist will also produce financial forecasting for your business. This will provide insights for what direction your business is heading to.

3. An audit hangs over your head.

An audit due can be a stressful experience. If it is your first time being audited, you should know what the audit process is. If you don’t have a professional accountant by now, it’s high time you get one. An accountant will work through your paperwork and help you organize and identify the information that the IRS will inquire about in the audit. Your hired accountant can also directly liaise with the IRS on your behalf. This will free up your time to work towards more productive and constructive goals.

Conclusion

MARIELA RUIZ, CPA, PLLC offers professional accounting and bookkeeping services in Mission, TX. We guarantee you success through our highly experienced team of accountants, tax experts, and bookkeepers. We don’t ask for your vote of confidence – we will earn it through our services. Get yourself an accountant at MARIELA RUIZ, CPA, PLLC or call us at (956) 997-0067 to book an appointment.